Advance & Reduction Option

- Featured Image

-

The Advance & Reduction Option can be a good choice for some members, but it may not be the right option for everyone. Read on to learn more.

The Advance & Reduction Option is a way to level your ATRF pension income with your Canada Pension Plan (CPP) benefits. This option will pay you more pension from the plan before age 65 and less pension after age 65.

The Advance & Reduction Option is only available to members who retire prior to age 64.

The advance is an optional payment that starts when your pension is granted and is paid monthly for your lifetime in addition to your ATRF pension. A permanent reduction to your ATRF pension will begin at age 65, and continues for your lifetime regardless of when you start to receive your CPP benefits, or whether the Government of Canada changes CPP eligibility requirements, benefits available, or tax rules.

What You Need to Consider

You may only choose the Advance & Reduction Option when you choose your pension option – you cannot choose to add it after your pension has been granted.

- The Advance & Reduction Option cannot be changed or cancelled once your pension payments begin.

- The Advance & Reduction Option is calculated to be cost-neutral resulting in no monetary benefit or cost to the plan.

- The Advance amount is calculated to have an equivalent actuarial value as the Reduction at the time of pension commencement.

- The Reduction amount is an estimate of your CPP benefit at age 65 based on your pensionable service under the plan.

- If you live longer than what is expected based on the calculation assumptions, the total amount of the reductions may exceed the total of the advances paid to you.

- Advances are considered as income and are taxed accordingly.

- Choosing the advance will not affect your CPP benefits which are paid directly from the Government of Canada.

- Cost-of-living adjustments are applied annually to the advance starting at pension commencement and to the Reduction starting at age 65.

- The Advance & Reduction Option stops at your death and does not continue to any surviving nominee, beneficiary, or estate.

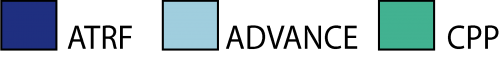

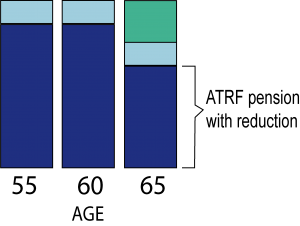

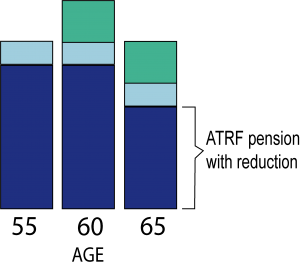

The following charts illustrate the effect of the ATRF Advance on your total pension income.

You take the advance at age 55 and an unreduced CPP benefit at age 65.

You take the advance at age 55 and a reduced CPP benefit at age 60.

You do not take the advance and take an unreduced CPP benefit at age 65.

You do not take the advance and take a reduced CPP benefit at age 60.

ATRF Pension Options

-

Choosing a Pension Option

Many plan members find it difficult to choose their pension option. There is not one pension option that is suitable for everyone, so your choice of pension option should reflect your personal situation. Speak to an ATRF Pension Counsellor if you have any questions about the pension options, or if you need help completing any of the forms.