Plan Member Statements and Commuted Values

It’s that time of the year: Yes, the holidays, but it’s also the annual plan member statements season. Your employers have submitted their year-end data, and we have started the production and distribution of your annual statements.

For many of our members, one item on the statement is your commuted value (CV). This figure appears on your annual statement if you are eligible, which is if you are less than age 55 with more than five years of pensionable service.

What is the Commuted Value?

A commuted value is the lump-sum of money that would need to be set aside today, at current market interest rates, to provide future pension payments. The CV is offered as an option when a plan member’s employment terminates and their participation in the plan ends. At that time, plan members can decide what to do with their pension benefit. They have various options, depending on their age and service.

For example, the CV is only offered as a termination benefit when the plan member is less than age 55. Each option needs to be carefully considered as they have different features. All of this is described in the termination benefit package plan members receive from ATRF following their termination.

If the plan member chooses to take the CV, they would receive a one-time lump-sum termination benefit from the plan instead of a future lifetime monthly pension benefit. By taking the commuted value, they are withdrawing all their funds and no longer have entitlements from the plan.

How is a Commuted Value Calculated?

The commuted value is calculated using the plan member’s age, service, salary, and assumptions including interest, inflation, and mortality rates. ATRF follows the standard of practice for determining commuted values recommended by the Canadian Institute of Actuaries (CIA).

Why Does the Commuted Value Change?

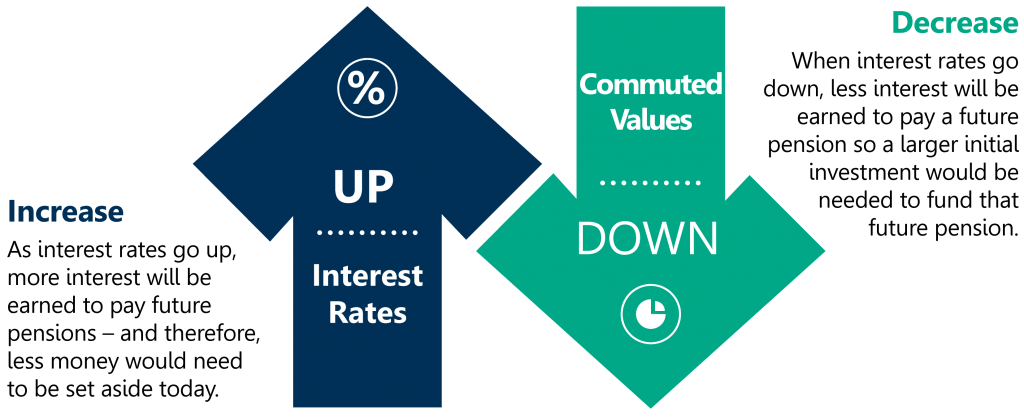

Changes to interest rates can cause the commuted value to change from month to month. When interest rates go down, less interest will be earned to pay a future pension. This means a larger initial investment would be needed to fund that future pension. As interest rates go up, more interest will be earned to pay your future pension – and therefore, less money would need to be set aside today.

In periods where there have been substantial increases in interest rates, the commuted value shown on a plan member’s most recent annual statement may be lower than the one shown on the prior year’s, even if more service is counted towards the pension.

Does a Change in Commuted Values Impact Pensions?

No. As long as the pension stays in the ATRF plan, changes in a member’s commuted value will not impact their pension.

That pension is based on a formula that includes the highest five-year average pensionable salary and pensionable years of service and will increase with additional years of pensionable service and salary. The pension is not based on the CV, investment returns, or interest rates, as long as it’s in the plan. If money is taken out of the plan upon termination, then a member’s future retirement income will be dependent on the CV, how it’s invested, and when it is drawn to pay a retirement income.

Do Commuted Values Changes Reflect the Health of the Plan?

Changes in commuted values are not indicative of the health of the plan, rather, they reflect changes in interest rates. Plan sustainability is maintained with appropriate funding using long-term interest assumptions and prudent risk management.