- Featured Image

-

At ATRF we focus on finding the right balance of risk and returns, and ensuring our investments are aligned with our strategic goals.

ATRF’s investment portfolio is structured to deliver the returns necessary to fund pension benefits over the long term. It is diversified by asset type, geography, and risk profile in order to control the impact of short-term volatility in investment markets to the extent possible.

As of 2021, responsibility for the direct management of ATRF investments was transferred to AIMCo as required by law. Today, ATRF plays the vital role of providing investment strategy that sets the direction for investing overall, and guides all the investment decisions made by AIMCo. ATRF also carefully monitors investment performance, paying particular attention to ensuring adherence to the strategy.

Long-Term Investment Performance

As a pension manager, ATRF focuses on the long-term investment results needed to fund our plans. We are very pleased to report that at the end of the 2023-24 fiscal year, over the trailing 10-year period ATRF’s investment portfolio had earned an annualized rate of return of 6.99%, surpassing the long-term average return assumption of 6.61% used in valuing the plan.

ATRF evaluates investment performance through a dual approach, comparing the fund’s overall assumption used in the funding valuations of the plans and assessing performance against a set of board-approved benchmarks. The total fund benchmark return is calculated by aggregating the benchmark returns of each individual asset class and weighing them according to the fund’s policy asset mix allocation.

ATRF’s investment strategy is designed to provide the returns necessary to fund the plan’s long-term obligations. As such, we carefully monitor our portfolio’s results against the long-term expected return assumptions used for funding purposes.

ATRF’s returns compared to long-term return assumptions:

- 1 Year: 6.91% compared to 6.50% return assumption

- 4 Year: 6.08% compared to 6.34% return assumption

- 10 Year: 6.99% compared to 6.61% return assumption

| Asset Class | ATRF 1 Year (%) | Benchmark 1 Year (%) | ATRF 4 Years (%) | Benchmark 4 Years (%) | ATRF 10 Years (%) | Benchmark 10 Years (%) |

|---|---|---|---|---|---|---|

| Growth | 12.18 | 20.48 | 11.61 | 12.69 | 9.80 | 10.44 |

| Growth: Global Equity | 19.28 | 20.55 | 10.90 | 11.17 | 8.31 | 9.32 |

| Growth: Private Equity | 0.43 | 21.73 | 15.44 | 17.19 | 16.59 | 13.78 |

| Inflation Sensitive (IS) | -4.76 | 3.47 | 3.08 | 7.92 | 8.21 | 6.57 |

| IS: Real Estate | -15.59 | 0.72 | -1.99 | 6.93 | 4.91 | 5.96 |

| IS: Infrastructure | 7.12 | 6.40 | 8.92 | 8.78 | 13.12 | 7.34 |

| Interest Rate Sensitive | 7.24 | 7.01 | -2.56 | -2.82 | 1.84 | 1.77 |

| Market Neutral | 8.94 | 7.72 | 6.19 | 5.06 | 4.28 | 5.01 |

| TOTAL PLAN | 6.91 | 12.37 | 6.08 | 7.49 | 6.99 | 7.23 |

Investment performance net of fees, as at August 31, 2024

Investment Performance Analysis

Fiscal 2023-24

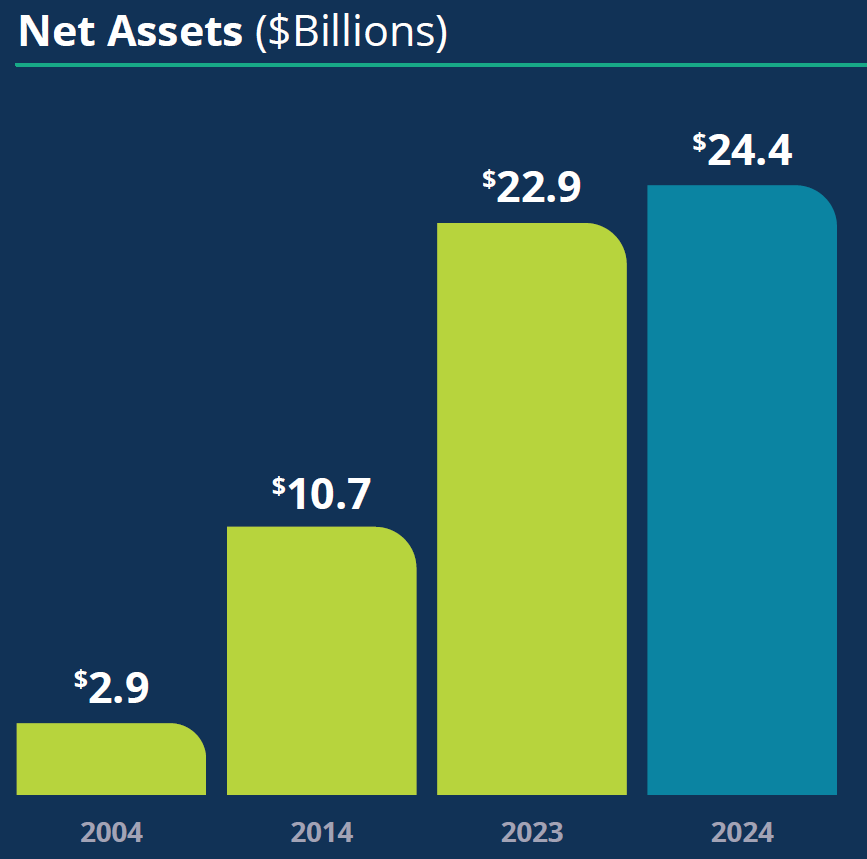

In the 2023-24 fiscal year, ATRF’s investment portfolio achieved a 6.91% return, ending with a total fund value of $24.4 billion as at August 31, 2024.

ATRF is a long-term investor, aiming to achieve an average return of 6.50% to meet pension obligations. That’s why we are pleased the 2023-24 return exceeded this objective, even though it fell short of the annual benchmark. Public equity investments produced the strongest performance with a 19.28% return driven by gains in technology and AI-related companies. Fixed income performed well amid stable bond yields. Higher interest rates affected both private equity and real estate investments, with the real estate office sector also facing challenges from changing market dynamics.

Over the past decade, ATRF’s portfolio has delivered a 6.99% annualized return, slightly above the long-term average return assumption of 6.50% used in valuing the plan. This steady performance underlines ATRF’s focus on long-term sustainability to confidently meet pension obligations. ATRF recently enhanced its investment approach by revising its strategic asset mix, (following page), effective January 1, 2024. This forward-looking strategy aims to strengthen the portfolio’s alignment with ATRF’s long-term goals and obligations, ensuring sustainable growth for the future.