- Featured Image

-

How Contribution Rates are Determined

The ATRF Board carefully reviews a number of factors when determining the plans’ contribution rates and adjusts contribution rates as required following each actuarial valuation.

Contribution rates are set to cover the cost of plan benefits currently being accrued, including cost-of-living adjustments. Retired members are eligible to receive an adjustment equal to 60% of the change in the Alberta Consumer Price Index (ACPI) for pensionable service prior to 1993 and 70% of the ACPI for pensionable service after 1992.

Active plan members and the Alberta Government or contributing employers share equally in funding for benefits related to pensionable service after August 1992, including the 60% cost-of-living adjustments. Active plan members are solely responsible for funding the additional 10% cost-of-living adjustments provided for pensionable service after 1992.

Plan deficiencies with respect to earned benefits must be funded over a 15-year period by additional contributions. These additional contributions are to be shared equally between active plan members and the Alberta Government or contributing employers.

However, active plan members alone are required to fund all the actual cost with respect to that portion of deficiencies related to the additional 10% cost-of-living benefit for pensionable service earned after 1992.

Contributions are not deducted during strikes or leaves of absences (other than health-related periods of maternity leaves). As well, you do not contribute on any salary above the maximum pensionable salary (or salary cap) in accordance with the Income Tax Act.

If you work part-time, your contributions are based on what you would have earned working full-time in your position and then adjusted with the percentage of full-time hours you work.

Year's Maximum Pensionable Earnings (YMPE)

Your monthly contribution to the plan is integrated with your contribution to the Canada Pension Plan (CPP) and takes the YMPE into consideration. The YMPE is the year’s maximum pensionable earnings covered by the CPP.

The YMPE for 2025 is $71,300.00, or $5,941.67 per month, which is called the monthly maximum pensionable earnings (MMPE). This maximum changes every January 1, and the amount of your ATRF contribution changes accordingly.

Contributions: Teachers’ Pension Plan - School Jurisdictions, Charter Schools and ATA Locals

Employer Contributions

As of September 1, 2025, the Alberta government or employer contribution is 8.92% of your pensionable salary.

Your Contributions

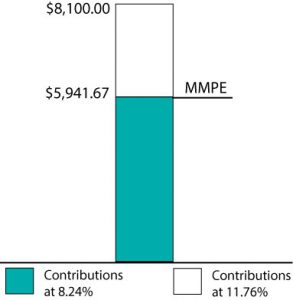

As of September 1, 2025, the employee contribution rate is 8.24% up to the monthly maximum Canada Pension Plan pensionable earnings level ($5,941.67 effective January 1, 2025) and 11.76% on pensionable earnings above that level.

An Example

If you made $8,100 per month in 2025, you would contribute:

- 8.24% of your monthly salary up to the 2025 MMPE of $5,941.67, and

- 11.76% of your monthly salary over $5,941.67, as shown below.

This is a monthly contribution of $743.41:

- $489.59 (which is 8.24% of $5,941.67), plus

- $253.82 (which is 11.76% of $2,158.33)

| Year | YMPE | MMPE | Employee Contr. Rates (%) | Monthly Salary Cap | Monthly Employee Max | Employer Contr. Rates (%) |

|---|---|---|---|---|---|---|

| Sept 2025 | $71,300 | $5,941.67 | 8.24/11.76 | $17,435.29 | $1,841.24 | 8.92 |

CPP earnings, contribution rates and capped salaries for the TPP in previous years

Contributions: Private School Teachers’ Pension Plan

Employer Contributions

As of September 1, 2025, the employer contribution rate is 9.01% of pensionable salary.

Your Contributions

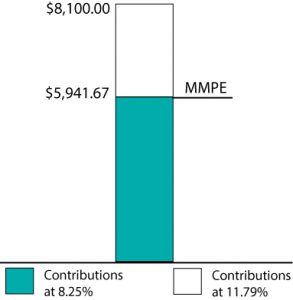

As of September 1, 2025, the employee contribution rate is 8.25% up to the monthly maximum Canada Pension Plan pensionable earnings level ($5,941.67 effective January 1, 2025), and 11.79% on pensionable earnings above that level.

An Example

An Example

If you made $8,100 per month during 2025, each month you would contribute:

- 8.25% of your monthly salary up to the 2025 MMPE of $5,941.67, and

- 11.79% of your monthly salary over $5,941.67, as shown below.

This is a monthly contribution of $744.66:

- $490.19 (which is 8.25% of $5,941.67), plus

- $254.47 (which is 11.79% of $2,158.33).

| Year | YMPE | MMPE | Employee Contr. Rates (%) | Monthly Salary Cap | Monthly Employee Max Contr. | Employer Contr. Rates (%) |

|---|---|---|---|---|---|---|

| Sept 2025 | $71,300 | $5,941.67 | 8.25/11.79 | $17,435.29 | $1,845.29 | 9.01 |

CPP earnings, contribution rates and capped salaries for the PSTPP in previous years

An Example

An Example