- Featured Image

-

The ATRF Board has established a funding policy that provides a framework for the sound financial management of the plans. The overall objective is the sustainability of the plans—to ensure the plans will be able to pay the pensions earned by members today and over the long term at a cost and risk acceptable to the plan sponsors.

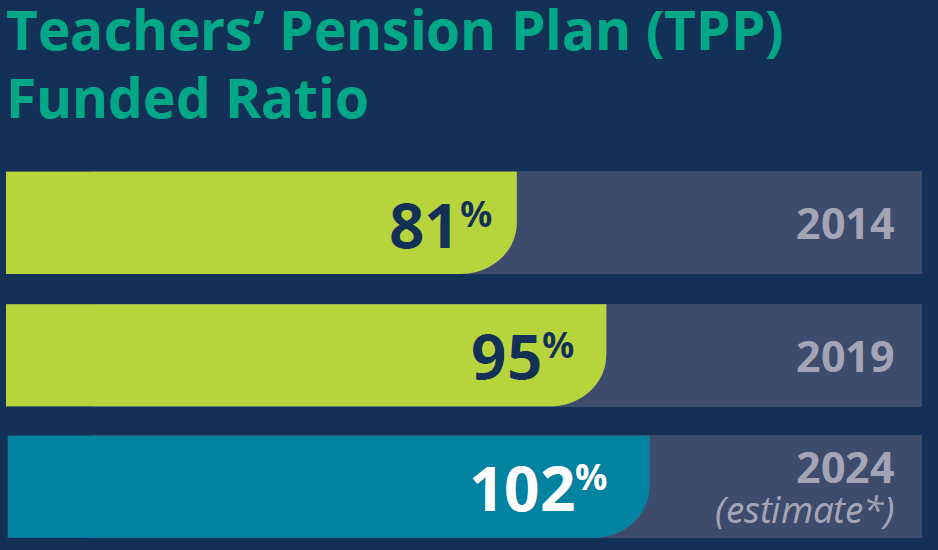

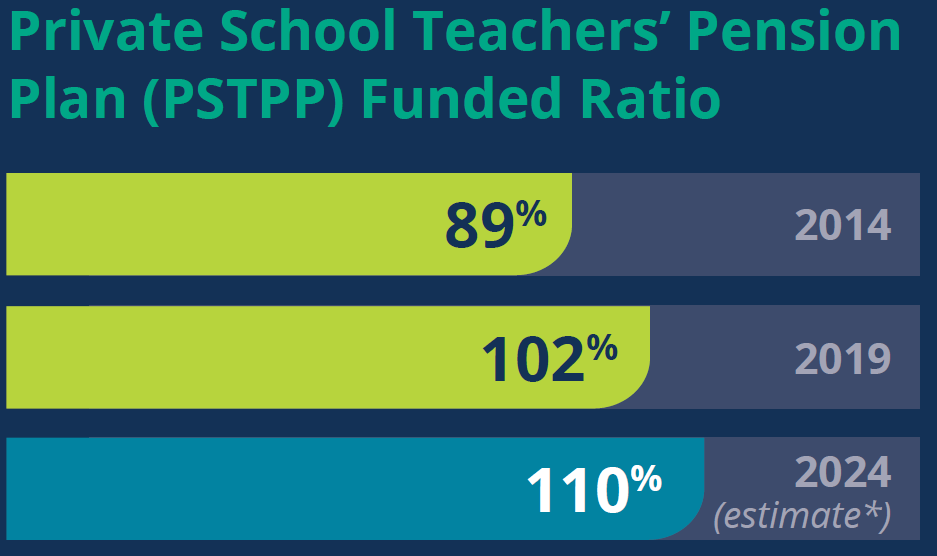

Plan Funding Status

The Teachers’ Pension Plan is fully funded again this year: 102% funded ratio as at Aug. 31, 2024. The Private School Teachers’ Pension Plan remains fully funded with a funded ratio of 110%.

Funded Ratio

| . | $ Millions |

|---|---|

| Market Value of Assets | 24,256 |

| Fluctuation Reserve | 544 |

| Funding Value of Assets | 24,800 |

| Funding Liabilities | 24,385 |

| Funding Surplus (Deficit) | 415 |

| Funded Ratio | 102% |

| . | $ Millions |

|---|---|

| Market Value of Assets | 133.2 |

| Fluctuation Reserve | 3.0 |

| Funding Value of Assets | 136.2 |

| Funding Liabilities | 124.4 |

| Funding Surplus (Deficit) | 11.8 |

| Funded Ratio | 110% |

Plan Structure and Funding

The Teachers’ Pension Plan and the Private School Teachers’ Pension Plan have three unique funding arrangements and liability structures:

- Teachers’ Pension Plan pre-1992: A 2007 agreement between the Government of Alberta (GOA) and the ATA assigns government responsibility for liabilities associated with pensions for the period of service before September 1992.

- Teachers’ Pension Plan post-1992: The cost of pension benefits earned for service after August 1992 is shared between active plan members and the GOA. Funding deficiencies under the plan are amortized by additional contributions from active members and the Government of Alberta over a maximum 15-year period.

- Private School Teachers’ Pension Plan: In 1995, legislation established a separate plan for private school teachers. The funding of this plan mirrors the post-1992 portion of the Teachers’ Pension Plan, except the cost is shared between teachers and employers (private schools) instead of the Government of Alberta.

Using expert analysis and advanced tools, ATRF conducts annual assessments of the plans’ financial health, or funded status, by comparing the value of the plan’s assets and liabilities. This exercise is called an actuarial valuation and must be filed with the Canada Revenue Agency (CRA) at least every three years. ATRF filed the last actuarial valuation performed as of August 31, 2023, with the CRA.

In monitoring the plans’ funded status, ATRF uses various actuarial assumptions and methods, including margins (or cushions), which protect against risks like lower-than-expected investment returns. These margins, an important risk management tool, help achieve our funding objectives of keeping contributions stable and benefits fully funded. Both plans currently have strong margins.

Investment returns can be volatile, which is why the plans use another key funding tool to minimize the impact of investment returns that are different than expected. Any investment returns that are higher or lower than expected are gradually reflected in the fund’s value over five years rather than being used at current market value. Using this funding value of assets method can dampen market volatility impacts on the plans’ funded status and help stabilize contribution rates. The difference between the market value and the funding value of assets is called the fluctuation reserve. The fluctuation reserve can be positive or negative but can never be more or less than 15% of the market value of assets. This industry-standard practice makes the plans less susceptible to the impact of short-term market ups and downs.